Streamline fund operations with an AI analyst

Streamline fund operations with an AI analyst

Streamline fund operations with an AI analyst

Faster access to portfolio data for investors and LPs, and efficient analysis across portfolio companies and funds

Faster access to portfolio data for investors and LPs, and efficient analysis across portfolio companies and funds

Faster access to portfolio data for investors and LPs, and efficient analysis across portfolio companies and funds

Backed by Y Combinator

Trusted by

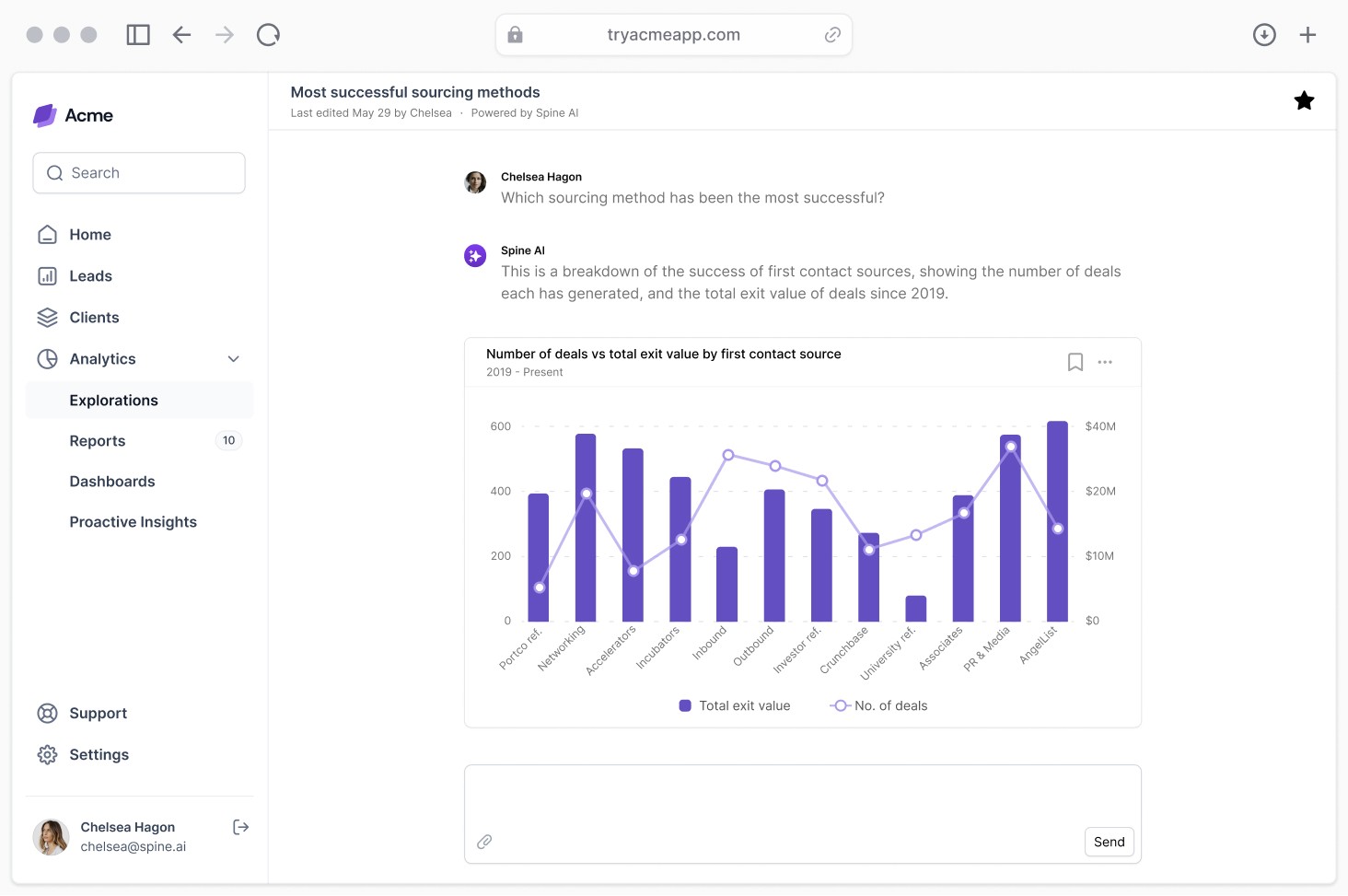

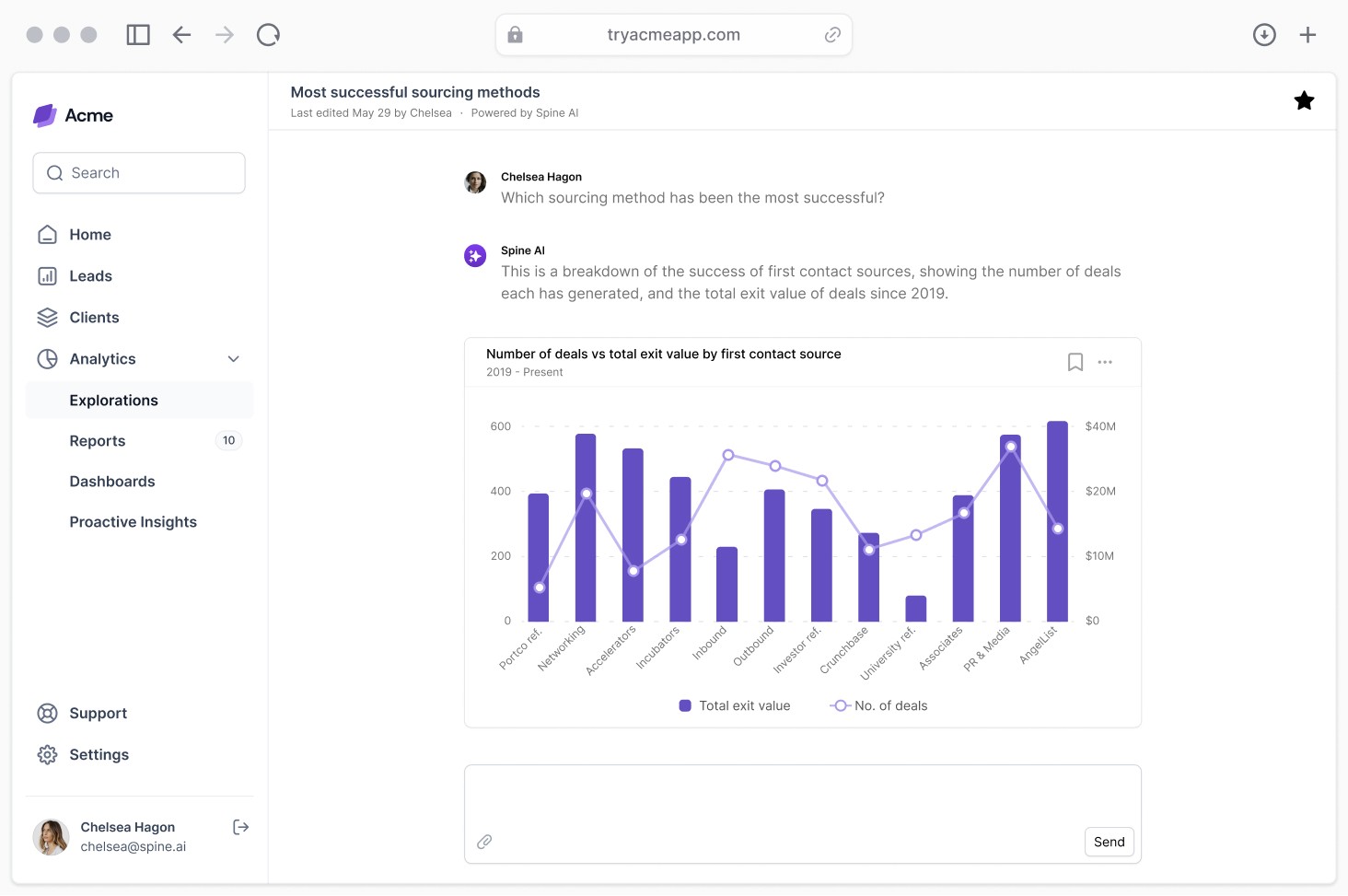

Answers to plain language questions

Save time on ad hoc questions, get answers to investors and LPs faster

Helen Parr

Which company has the highest increase in profits and why?

Process

Collapse

Searching through database “portfolio_companies”

Reviewing investor update decks from unstructured sources

Filtered with period fiscal year 2024, period fiscal quarter Q4, and period length LTM

Acme Inc. has had the highest jump of 87% in profits. This is largely due to their investments in using AI to reduce their Opex as cited in their last investor update

Helen Parr

Which company has the highest increase in profits and why?

Process

Collapse

Searching through database “portfolio_companies”

Reviewing investor update decks from unstructured sources

Filtered with period fiscal year 2024, period fiscal quarter Q4, and period length LTM

Acme Inc. has had the highest jump of 87% in profits. This is largely due to their investments in using AI to reduce their Opex as cited in their last investor update

Real self-serve answers for ad hoc questions

Give your organization direct access to portfolio and fund data, with plain language chat that can accurately answer their questions with structured and unstructured data

Give your organization direct access to portfolio and fund data, with plain language chat that can accurately answer their questions with structured and unstructured data

Give your organization direct access to portfolio and fund data, with plain language chat that can accurately answer their questions with structured and unstructured data

Access custom views of structured data, such as summarizing performance metrics by fund, or confirming total investment size per company

Access custom views of structured data, such as summarizing performance metrics by fund, or confirming total investment size per company

Access custom views of structured data, such as summarizing performance metrics by fund, or confirming total investment size per company

Get a more complete understanding of the context behind portfolio performance with unstructured data from board meeting decks, company update emails and investor notes

Get a more complete understanding of the context behind portfolio performance with unstructured data from board meeting decks, company update emails and investor notes

Get a more complete understanding of the context behind portfolio performance with unstructured data from board meeting decks, company update emails and investor notes

Customized for your data and your funds

Truly plain language. No query language to learn.

Truly plain language. No query language to learn.

Truly plain language. No query language to learn.

Use internal terminology and acronyms, exactly as you would with a human analyst

Use internal terminology and acronyms, exactly as you would with a human analyst

Use internal terminology and acronyms, exactly as you would with a human analyst

Direct control over custom measures ensures that growth rates, MOIC, TVPI, RVPI and everything else is calculated exactly as you expect

Direct control over custom measures ensures that growth rates, MOIC, TVPI, RVPI and everything else is calculated exactly as you expect

Direct control over custom measures ensures that growth rates, MOIC, TVPI, RVPI and everything else is calculated exactly as you expect

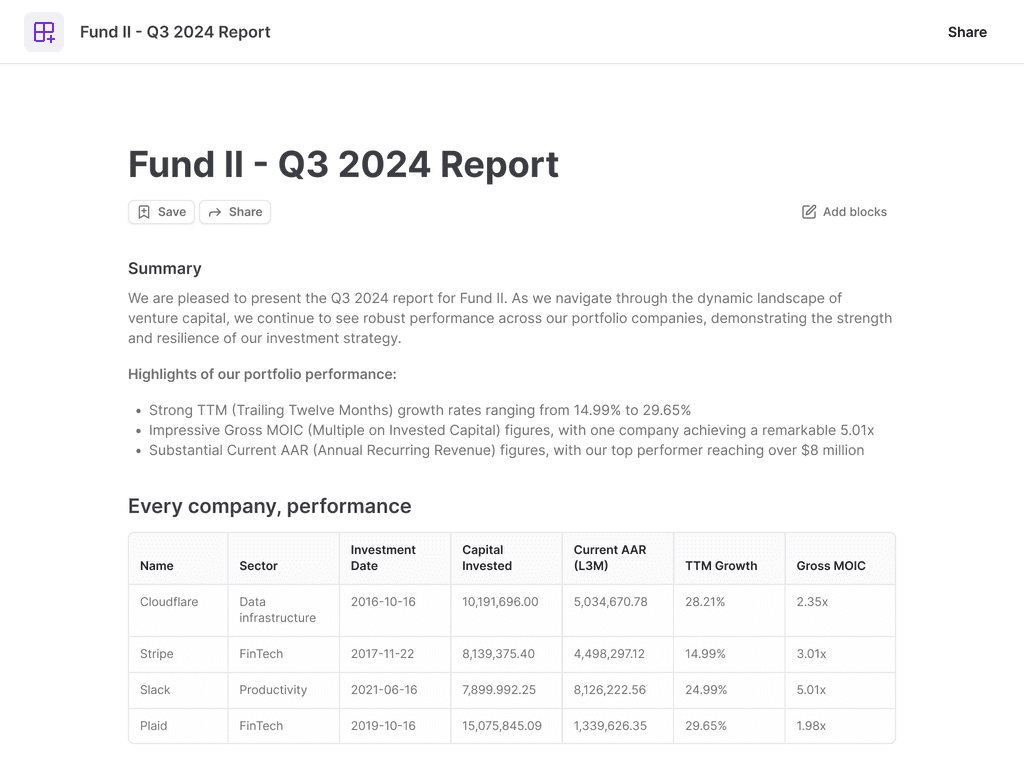

Fund II – All Metrics

Last edited May 29 by Esther

Fund II – Follow on investments

Last edited Jun 06 by Louis

Fund II – Every company, performance

Last edited yesterday by Annie

Fund II – Summary of cash transactions

Last edited May 29 by Esther

Fund II – All Metrics

Last edited May 29 by Esther

Fund II – Follow on investments

Last edited Jun 06 by Louis

Fund II – Every company, performance

Last edited yesterday by Annie

Fund II – Summary of cash transactions

Last edited May 29 by Esther

Process

Collapse

Query: when was our most recent investment in stripe?

Retrieved relevant data from the cash_transactions table

Filtered with investment as Stripe

Sorted with transactionDate in descending order

Process

Collapse

Query: when was our most recent investment in stripe?

Retrieved relevant data from the cash_transactions table

Filtered with investment as Stripe

Sorted with transactionDate in descending order

Full transparency into the source of answers

Simple step by step explanations of the process make it clear how the question was interpreted, what data source was accessed, and how it was processed to produce the response

Simple step by step explanations of the process make it clear how the question was interpreted, what data source was accessed, and how it was processed to produce the response

Simple step by step explanations of the process make it clear how the question was interpreted, what data source was accessed, and how it was processed to produce the response

Control which default metrics are associated with key concepts, like fund or investment performance

Control which default metrics are associated with key concepts, like fund or investment performance

Control which default metrics are associated with key concepts, like fund or investment performance

Nuanced questions flagged for human review

Add metrics across all companies in your portfolio from iLevel, spreadsheets, PPTs, and PDFs

Add metrics across all companies in your portfolio from iLevel, spreadsheets, PPTs, and PDFs

Add metrics across all companies in your portfolio from iLevel, spreadsheets, PPTs, and PDFs

Validate and show discrepancies in the data so you can choose the actual source of truth

Validate and show discrepancies in the data so you can choose the actual source of truth

Validate and show discrepancies in the data so you can choose the actual source of truth

Extract and update all metrics for a single company for a new quarter, even if updates come from a PDF or slide deck.

Extract and update all metrics for a single company for a new quarter, even if updates come from a PDF or slide deck.

Extract and update all metrics for a single company for a new quarter, even if updates come from a PDF or slide deck.

Noah Pierre

Any signs of outperformers/breakouts in our portfolio?

Spine AI

Low confidence

Submit to Analyst

Retrieved relevant data from the actual_with_Itm and investment tables

Filtered with period_length as L3M and arr_growth_percent, gross_irr, enterprise_value greater than or equal to their thresholds

Identified breakout companies in the portfolio

Noah Pierre

Any signs of outperformers/breakouts in our portfolio?

Spine AI

Low confidence

Submit to Analyst

Retrieved relevant data from the actual_with_Itm and investment tables

Filtered with period_length as L3M and arr_growth_percent, gross_irr, enterprise_value greater than or equal to their thresholds

Identified breakout companies in the portfolio

Keep your data and analysis up to date, with minimal manual verification

Keep your data and analysis up to date, with minimal manual verification

Acme, Inc

...

Acme's projected performance

New metrics are available for Acme's projected financial performance in two recently uploaded documents:

Acme company update

Board_meeting_Oct 23.pptx

October 26, 2024

Extract data from board decks and company updates as they become available

Keep structured performance metrics up to date and save on hours of manually reviewing documentation for new performance projections.

Automated discrepancy detection across data sources, and structured data extraction save time and improve accuracy.

Maintain an auditable record of the source of data.

Automatically propagate updated data to reports and dashboards for valuation analysis, quarterly reporting and more

Spine integrates seamlessly with the tools you already use

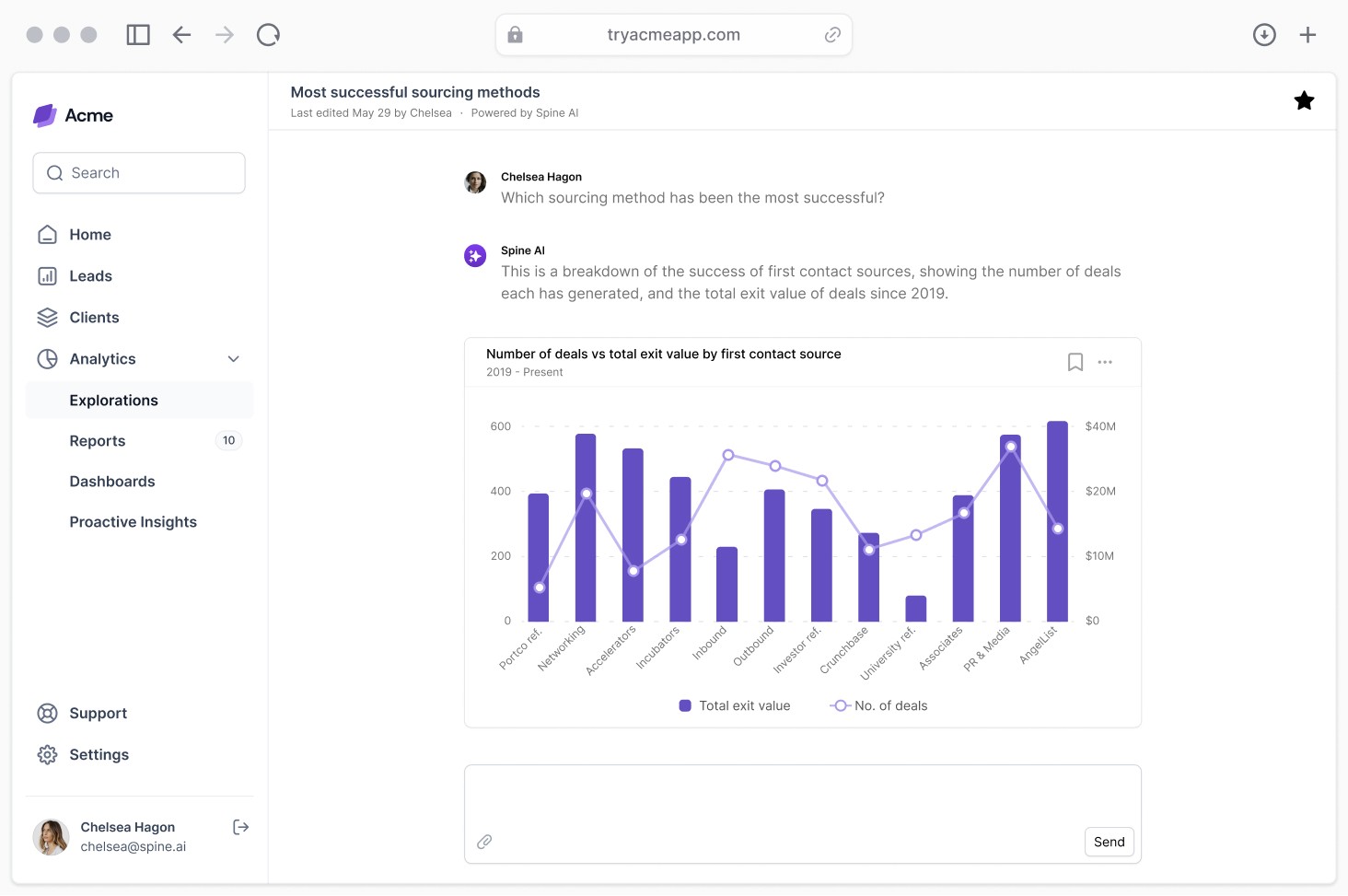

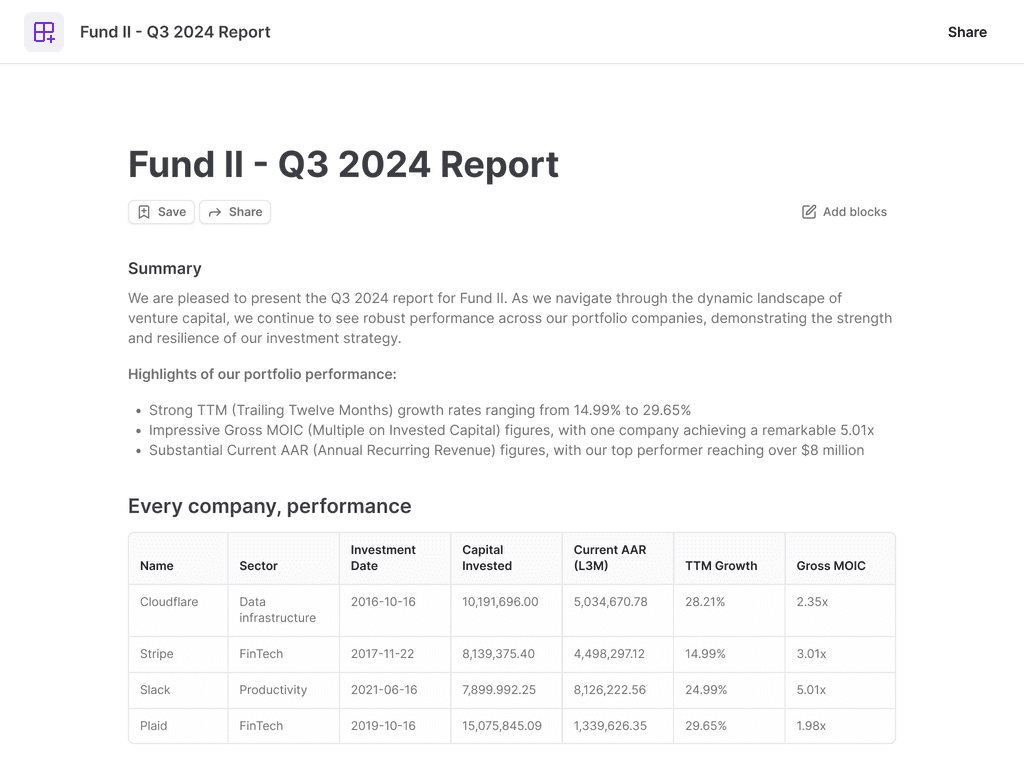

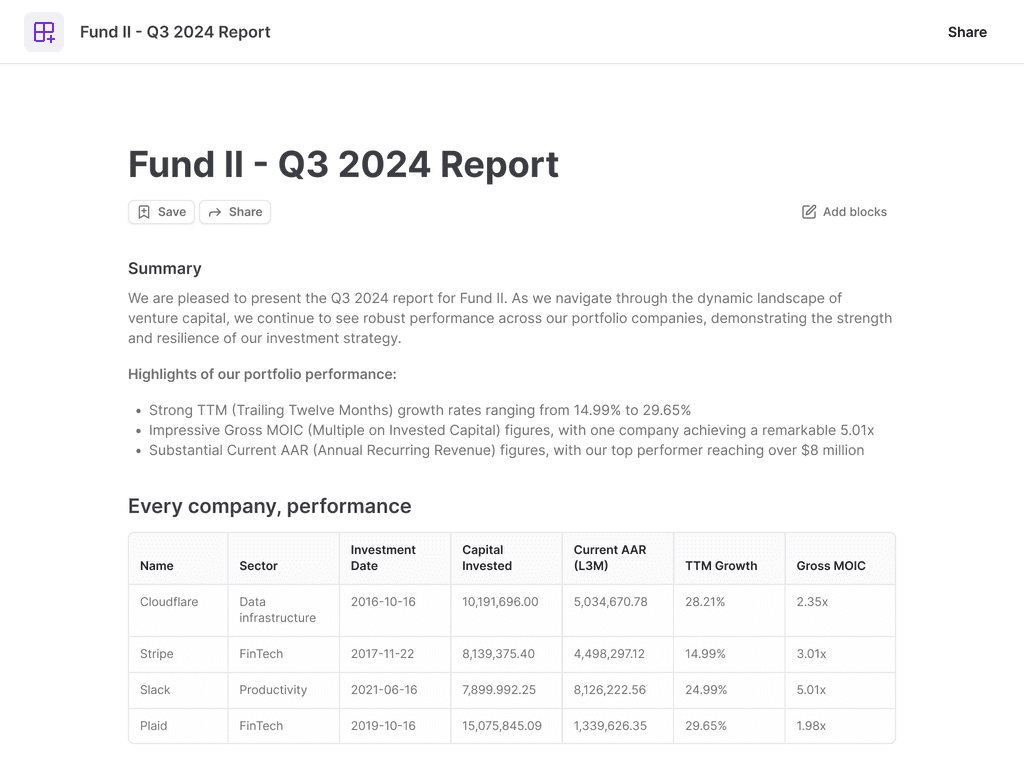

Dynamic dashboards and reports

Custom reporting that shows the full picture and makes analysis scalable

Custom reporting that shows the full picture and makes analysis scalable

Bring together data and the context to make sense of it

Gather all the information you need for comprehensive analysis in one place.

Gather all the information you need for comprehensive analysis in one place.

Gather all the information you need for comprehensive analysis in one place.

Not just structured data and metrics. Incorporate relevant context from unstructured documents, such as board decks or meeting notes.

Not just structured data and metrics. Incorporate relevant context from unstructured documents, such as board decks or meeting notes.

Not just structured data and metrics. Incorporate relevant context from unstructured documents, such as board decks or meeting notes.

Automatically search relevant documents to uncover key context, such as changes to the competitive landscape, growth strategy, or market demand.

Automatically search relevant documents to uncover key context, such as changes to the competitive landscape, growth strategy, or market demand.

Automatically search relevant documents to uncover key context, such as changes to the competitive landscape, growth strategy, or market demand.

Add your own notes to track additional context, such as the deal team's commentary, or rationale for valuation multiples.

Add your own notes to track additional context, such as the deal team's commentary, or rationale for valuation multiples.

Add your own notes to track additional context, such as the deal team's commentary, or rationale for valuation multiples.

Acme Inc: Active users over time

400

300

200

100

0

0

100

200

300

400

Add to AI chat

Add to new report

Inspect data source

Use as template

Share

Save time on repetitive analysis with templates

Automate context gathering for standard analysis by using templates for quarterly reporting by fund, valuation reports for portfolio companies, or monitoring reports for LPs.

Automate context gathering for standard analysis by using templates for quarterly reporting by fund, valuation reports for portfolio companies, or monitoring reports for LPs.

Automate context gathering for standard analysis by using templates for quarterly reporting by fund, valuation reports for portfolio companies, or monitoring reports for LPs.

Retain the flexibility to refine and adjust what information is included.

Retain the flexibility to refine and adjust what information is included.

Retain the flexibility to refine and adjust what information is included.

Fully customizable content powered by AI

Gain the efficiencies of AI features but stay in control of the final content

Gain the efficiencies of AI features but stay in control of the final content

Gain the efficiencies of AI features but stay in control of the final content

Autogenerate charts from existing data, or manually customize their format

Autogenerate charts from existing data, or manually customize their format

Autogenerate charts from existing data, or manually customize their format

Summarize all the content on a page to draft quarterly reports or valuations memos

Summarize all the content on a page to draft quarterly reports or valuations memos

Summarize all the content on a page to draft quarterly reports or valuations memos

Add block

AI Exploration

AI Summary

Chart

Table

Note

Backed by the best

Streamline your FundOps and make the most of your portfolio data, with an AI analyst.